Irs depreciation calculator

Estimate your tax withholding with the new Form W-4P. This Depreciation Calculator spreadsheet was designed to demonstrate how to perform various depreciation calculations for a variety of depreciation methods.

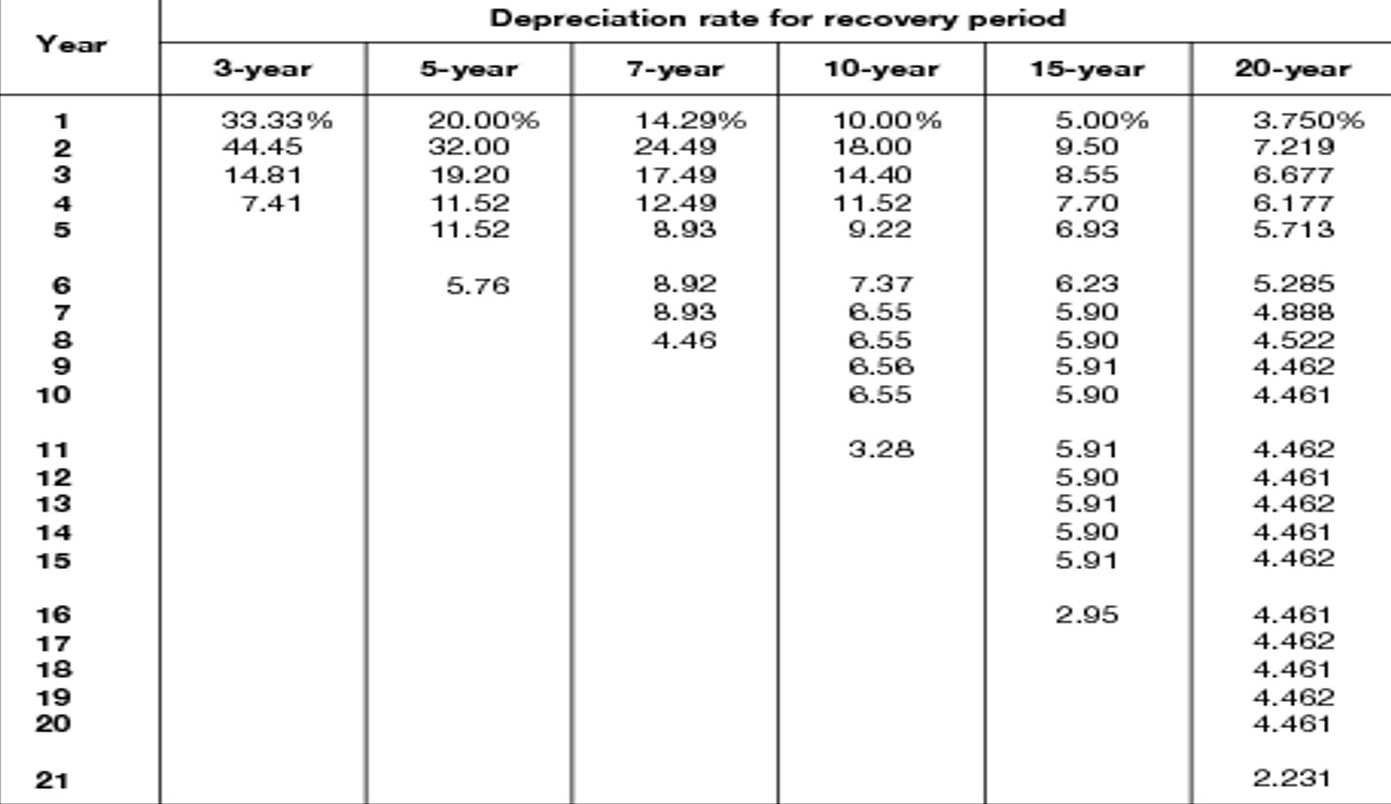

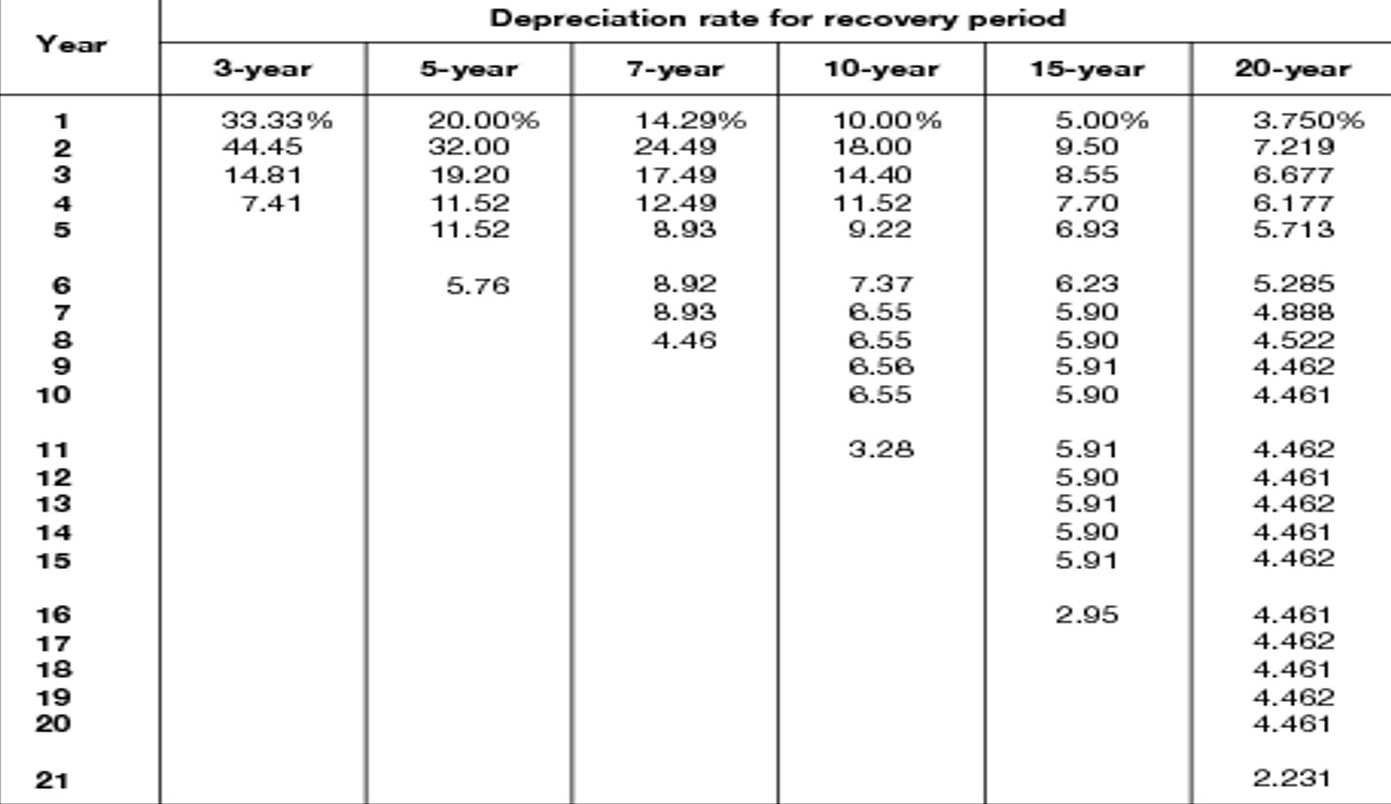

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Depreciation recapture tax rates.

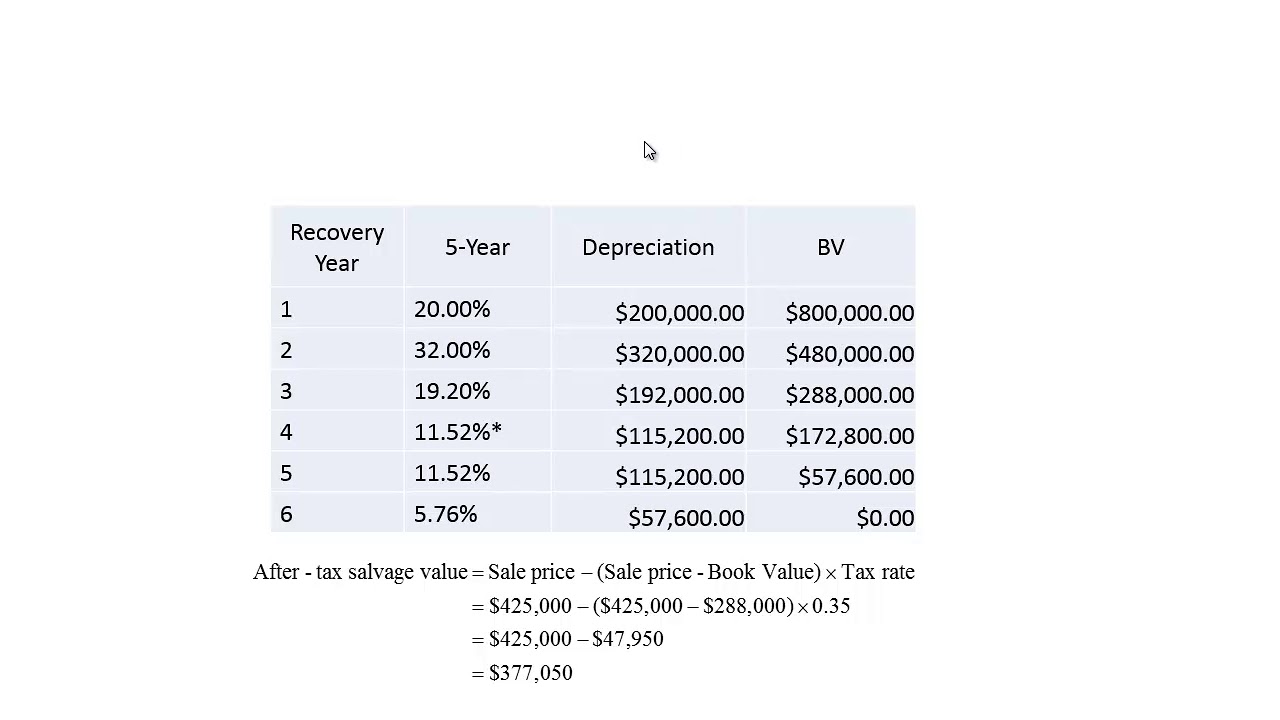

. Since depreciation recapture is taxed as ordinary income as opposed to capital gains your depreciation recapture tax rate is going to be your. The MACRS Depreciation Calculator uses the following basic formula. Make the election under section 179 to expense certain property.

Where Di is the depreciation in year i. It provides a couple different methods of depreciation. The two types of.

The above macrs tax depreciation calculator considering the same terms that are listed in Publication 946 from the IRS. 1 in-depth understanding of the types and amounts of qualifying short-life assets 2 statistical. Tax provisions accelerate depreciation on qualifying business equipment office furniture technology software and other business items.

This depreciation calculator is for calculating the depreciation schedule of an asset. That means the total deprecation for house for year 2019 equals. Ad Get Access to Expert Tax Depreciation Solutions to Make the Complex Simple.

Select the currency from the drop-down list optional Enter the. Claim your deduction for depreciation and amortization. This is the section 179.

All you need to do is. C is the original purchase price or basis of an asset. Expertly Manage the Largest Expenditure on the Balance Sheet with Efficiency Confidence.

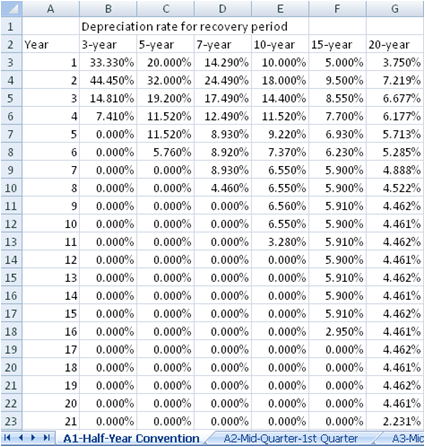

D i C R i. Use Notice 1392 Supplemental Form W-4 Instructions for Nonresident Aliens. 270000 x 1605 43335.

Types of MACRS Asset Classes for Property. The bonus depreciation calculator is proprietary software based on three primary components. First one can choose the straight line method of.

Also includes a specialized real estate property calculator. The calculator also estimates the first year and the total vehicle depreciation. Calculate depreciation and create a depreciation schedule for residential rental or nonresidential real property related to IRS form 4562.

Note that this figure is essentially equivalent to. Depreciation deduction for her home office in 2019 would be. NW IR-6526 Washington DC 20224.

You can elect to recover all or part of the cost of certain qualifying property up to a limit by deducting it in the year you place the property in service. Depreciation calculators online for primary methods of depreciation including the ability to create depreciation schedules. Use Form 4562 to.

Provide information on the. It is not intended to be used. Or you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave.

You have nonresident alien status. For every year thereafter youll depreciate at a rate of 3636 or 359964 as long as the rental is in service for the entire year. Uses mid month convention and straight-line.

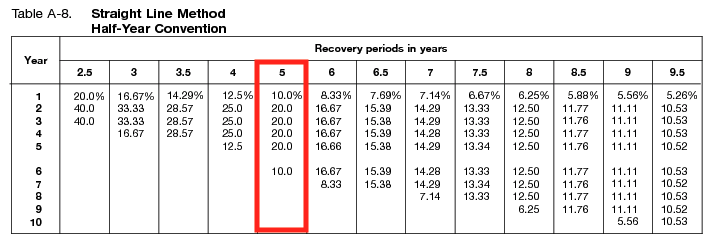

This illustrates tables 2-2 a through 2-2. It is fairly simple to use. The general idea behind car depreciation for taxes is to spread the cost of a car out over its useful life instead of writing off its whole cost the year you buy it.

Guide To The Macrs Depreciation Method Chamber Of Commerce

Depreciation Schedule Template For Straight Line And Declining Balance

Free Modified Accelerated Cost Recovery System Macrs Depreciation

Double Teaming In Excel

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Automobile And Taxi Depreciation Calculation Depreciation Guru

Macrs Depreciation Definition Calculation Top 4 Methods

Macrs Depreciation Calculator With Formula Nerd Counter

Depreciation Macrs Youtube

Depreciation Accounting Macrs Depreciation Modified Accelerated Cost Recovery System Youtube

Macrs Depreciation Calculator Straight Line Double Declining

Macrs Depreciation Calculator With Formula Nerd Counter

The Mathematics Of Macrs Depreciation

Macrs Depreciation Calculator Table Calculator Table Guide Fixed Asset

Free Macrs Depreciation Calculator For Excel

Solved Depreciation Rate For Recovery Period Year 3 Year Chegg Com

Modified Accelerated Cost Recovery System Macrs A Guide